Medicare Advantage plans, also known as Medicare Part C plans, are provided by private insurance companies approved by Medicare. Medicare Advantage plans provide coverage for all the services offered by Original Medicare, as well as other healthcare benefits such as prescription drug coverage. Medicare Part C covers different prescription drug types, helping you save money on your medications and reduce out-of-pocket costs.

Prescription Drug Coverage Under Medicare Advantage

Private health insurance companies manage Medicare Advantage plans, so the benefits vary between plans. However, many of the plans cover prescription drugs. When you register for a Medicare Part C plan, the private health insurance company will provide a formulary. The formulary lists the medications that are covered under the beneficiary’s plan.

The formulary is required by Medicare to cover different tiers of drugs. Each formulary must contain at least 2 drugs in the most common medication categories, such as blood pressure and diabetes medications.

- Usually, generic drugs are the lowest-cost drugs, and they serve as the alternative to brand-name drugs. You can find most of the generic drugs in the formulary Tier 1, and this has the lowest copayment.

- Tier 2 medications have an average copayment and mostly include brand-name drugs and a couple of generic drugs.

- Tier 3 drugs have a higher copayment, which includes both brand name and generic prescription drugs.

- Specialty-tier drugs are the ones that have a higher cost, so you pay the highest copayment.

The insurer will have to approve all the medications listed on the Medicare Advantage plan’s formulary, and each plan will vary according to how the drugs are organized on their formulary. Before you enroll for Medicare Part C, you should review the formulary of the plan. While you may not find a formulary that contains all the drugs you require, opting for a Medicare Advantage plan that has the most coverage can save you money.

Finding a Medicare Advantage Plan with Prescription Drug Coverage

There are several ways to find Medicare Advantage plans with prescription drug coverage. If you qualify for a Medicare Advantage Special Needs Plan, these plans are required to provide prescription drug coverage.

Choosing a plan with prescription drug coverage can be challenging at a glance, but iHealthcare Direct can help you compare every Medicare Advantage plan available in your area. Our experienced Medicare experts can filter the available options according to your needs and then evaluate them side by side.

Contact iHealthcare Direct today for any Medicare-related questions and assistance about Medicare Advantage and prescription drug coverage.

Medicare Supplement Plans, also referred to as Medigap, are not stand-alone Medicare Plans. They fill in the gaps in the Original Medicare Plan where the plan’s coverage stops. These plans are provided by private insurance companies, but they are approved by Medicare.

Original Medicare and Medigap

Original Medicare is composed of two of the four parts of Medicare: Part A and Part B. Medicare Part A is considered “hospital insurance,” while Medicare Part B is considered more along the lines of actual “health insurance,” since it covers sick visits and preventative services.

Once you enroll in the Original Medicare Plan, you’re eligible to enroll in a Medicare Supplement Plan or Medigap. Enrolling in one of these supplement plans does not replace your Original Medicare Plan — it simply helps reduce your out-of-pocket costs that are caused by what is not covered under Original Medicare.

Medigap assists with deductibles, copayments, and coinsurance costs. Some of the Medigap plans that are offered also offer coverage for things that Original Medicare would not, such as medical care when traveling outside the United States.

Medicare Advantage and Medigap

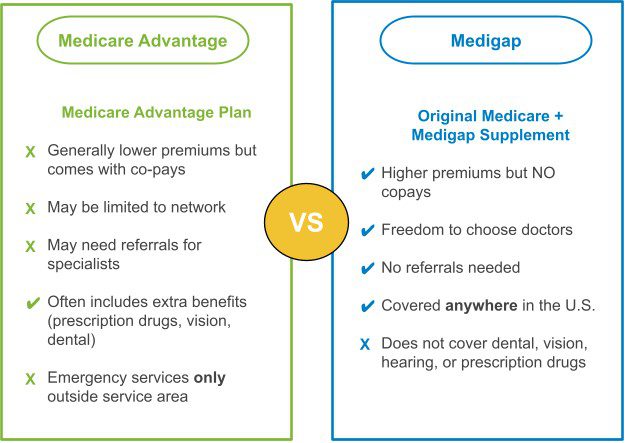

You cannot be enrolled in a Medicare Advantage Plan and a Medigap Plan at the same time. You’re only eligible for a Medigap Plan if you have both Parts A and B. Medicare Advantage Plans, also known as Medicare Part C, provide and usually exceed the benefits offered by Original Medicare.

Medigap fills in for Original Medicare; Medicare Advantage Plans not only provide hospital and medical coverage, but they also typically offer prescription drug coverage, as well as vision, dental, and hearing benefits. Some even offer transportation to and from the doctor and a free or discounted gym membership.

One advantage of being enrolled in Original Medicare and a Medicare Supplement Plan, though, is that you’re eligible to receive treatment anywhere across the United States, as long as they accept Medicare. When enrolled in a Medicare Advantage Plan, you typically enroll in either an HMO (Health Maintenance Organization plan) or a PPO (Preferred Provider Organization plan).

HMOs and PPOs have in-network providers that they prefer you to choose from. If you decide to seek out-of-network treatment, then you’ll pay more out-of-pocket, and may not receive any aid from your Medicare Advantage Plan at all. However, a PPO plan is a bit more lenient than HMO.

Important Facts To Know About Medigap Policies

Remember, in order to enroll in a Medicare Supplement Plan, you must first enroll in Medicare Parts A and B, aka Original Medicare. Medicare Supplement Plans and Medicare Advantage Plans are not the same types of plans.

- Medigap helps fill the gaps to ease your out-of-pocket costs.

- Medicare Advantage Plans actually provide full health insurance coverage once enrolled.

You may also be required to pay a monthly premium for your Medigap Plan. If so, you’re still responsible for paying the Medicare Part B monthly premium as well. As of 2006, Medigap plans cannot cover prescription medications, so you must purchase a separate Medicare Part D drug coverage plan. You’re also responsible for that premium, although some people qualify for the Extra Help program.

Want to Learn More? Reach Out Today

At iHealthcare, we care about providing you with as much information as possible about your Medicare options. If you’re interested in a Medicare Supplement Plan and would like to learn more about the coverage involved with a Medicare Supplement, give us a call today. We’re here to help!

Medicare is a federal health insurance program designed to cover medical costs for citizens or legal residents that are 65 years old or older. Some people who are under 65 can also enroll in the program if they meet certain qualifications.

Medicare consists of various parts. Part A and Part B are known as Original Medicare, while Part C is known as Medicare Advantage. There is also Medicare Part D and Medicare Supplements.

Medicare Part A

Medicare Part A, which is part of what is known as Original Medicare, provides coverage for inpatient hospital services. Beneficiaries who are admitted to a hospital based on a doctor’s order will get coverage for certain hospital costs.

Under Part A, you’ll also get coverage for skilled nursing facility care, hospice care, and some home healthcare services. For beneficiaries who have paid the necessary Medicare taxes while employed, there will also be no premium for Part A.

Medicare Part B

Part B is the second part of Original Medicare. Under Part B, Medicare beneficiaries get coverage for outpatient healthcare services such as preventive screenings, doctor visits, durable medical equipment, and more. Many Medicare enrollees enroll in Part A and Part B to get more coverage for their healthcare expenses.

In some cases, Part B will also cover certain prescriptions, like immunosuppressants or anticancer drugs.

Medicare Advantage

Medicare Advantage is also called Medicare Part C and covers the same services as Parts A and B. It covers inpatient and outpatient procedures and services like doctor visits, preventive screenings, hospice care, medical equipment, and other medical expenses.

Most Medicare Advantage plans also include coverage for prescription drugs and extra benefits such as routine hearing, dental, vision, and more. However, to enroll in Medicare Advantage, you must be enrolled in Original Medicare. Also, you must continue to pay your Part B premiums, though some Part C plans may not even have a premium.

Medicare Part D

Medicare Part D provides coverage for at least two drugs in each class or category. These plans are also required to cover most, if not all drugs listed in these specific categories:

- Anticonvulsants

- Antipsychotics

- Anticancer

- Antidepressants

- Immunosuppressants

- HIV/AIDS drugs

Medicare Supplement Plans

Medicare Supplements, also known as Medigap, help to cover the out-of-pocket expenses that Original Medicare does not cover. While each Medigap plan provides different coverage, here is a general idea of what could be covered:

- Coinsurance

- Copayments

- Deductibles

- Excess charges

- Foreign travel emergency care

- Blood transfusions

What Does Medicare Not Cover?

While Medicare does cover quite a bit of services, there are some services that Medicare does not cover, such as acupuncture, cosmetic procedures and medications, and long-term care. This is why it is important to understand what each part covers before you enroll.

To learn more about what each part of Medicare covers and what your options are, reach out to us today by giving us a call at 713-900-1901.