ACA RESOURCES

New: 2024

Federal Poverty Guidelines

For Premium Tax credit (Subsidy)

Tax Credits can help lower your cost of your health insurance.

To qualify for tax credit your income must be between 100% to 400% of the Federal Poverty Level

To qualify for tax credit your income must be between 100% to 400% of the Federal Poverty Level

| Family Size | 100% | 138% | 150% | 200% | 250% | 300% | 400% | 600% |

| 1 | $14,580 | $20,120 | $21,870 | $29,160 | $36,450 | $43,740 | $58,320 | $87,480 |

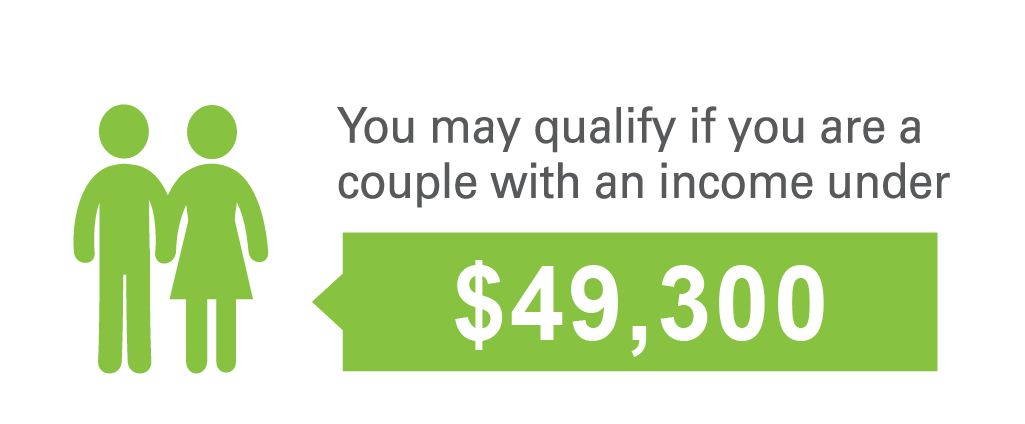

| 2 | $19,720 | $27,214 | $29,580 | $39,440 | $49,300 | $59,160 | $78,880 | $118,320 |

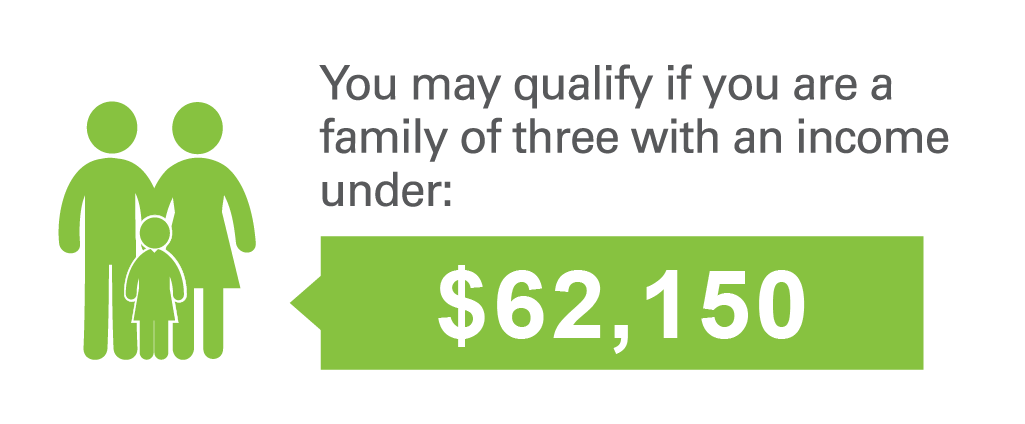

| 3 | $24,860 | $34,307 | $37,290 | $49,720 | $62,150 | $74,580 | $99,440 | $149,160 |

| 4 | $30,000 | $41,400 | $45,000 | $60,000 | $75,000 | $90,000 | $120,000 | $180,000 |

| 5 | $35,140 | $48,493 | $52,710 | $70,280 | $87,850 | $105,420 | $140,560 | $210,840 |

| 6 | $40,280 | $55,586 | $60,420 | $80,560 | $100,700 | $120,840 | $161,120 | $241,680 |

| 7 | $45,420 | $62,680 | $68,130 | $90,840 | $113,550 | $136,260 | $181,680 | $272,520 |

| 8 | $50,560 | $69,773 | $75,840 | $101,120 | $126,400 | $151,680 | $202,240 | $303,360 |

Do You Qualify For Financial Assistance?

New: 2024

Guía Federal De Pobreza

El Subsidio Del Gobierno

El Subsidio o la ayuda financiera se aplican en la prima mensual bajando el costo de su seguro de salud.

| Family Size | 100% | 133% | 138% | 150% | 200% | 250% |

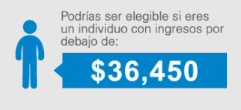

| 1 | $14,580 | $19,391 | $20,120 | $21,870 | $29,160 | $36,450 |

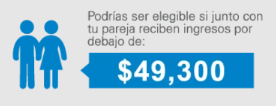

| 2 | $19,720 | $26,228 | $27,214 | $29,580 | $39,440 | $49,300 |

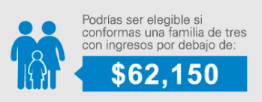

| 3 | $24,860 | $33,064 | $34,307 | $37,290 | $49,720 | $62,150 |

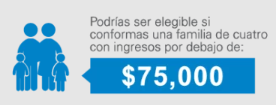

| 4 | $30,000 | $39,900 | $41,400 | $45,000 | $60,000 | $75,000 |

| 5 | $35,140 | $46,736 | $48,493 | $52,710 | $70,280 | $87,850 |

| 6 | $40,280 | $53,572 | $55,586 | $60,420 | $80,560 | $100,700 |

| 7 | $45,420 | $60,409 | $62,680 | $68,130 | $90,840 | $113,550 |

| 8 | $50,560 | $67,245 | $69,773 | $75,840 | $101,120 | $126,400 |

¿Eres elegible para recibir ayuda financiera?

2024 Calculator

Assess Your Financial Assistance Eligibility

Discover your potential eligibility for financial assistance beyond your employer's offerings with our 2024 Calculator. By evaluating the affordability of your lowest-cost employer plan, this tool provides estimates for you and your family members, ensuring you make informed decisions about your healthcare options.

We will help you choose an affordable health plan.

Helping individuals and families access affordable healthcare. iHealthcare offers personalized services to our clients, helping them find the best possible healthcare solutions for their needs.

Get A Quote