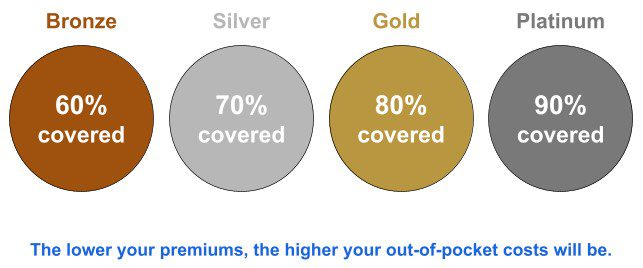

The health insurance plans under the Affordable Care Act (ACA) are divided into four categories, referred to as the “metal” levels, as they are ranked as Bronze, Silver, Gold, and Platinum. Each level is determined by its actuarial value (the percentage of how much your plan pays for benefits covered by the insurance). Metal categories are based on how you and your insurance plan divide the costs of your care — they don’t refer to the quality of care.

iHealthcare Direct can help you determine which level of health coverage is right for you.

The Bronze Level

In the Bronze level, the insurance company pays roughly 60% of medical costs, and you pay 40%. This category is good for those who want the protection for serious medical emergencies, but don’t need as much coverage for routine procedures, general health and wellness care, and screenings.

The Bronze level has the lowest monthly premium but also covers the least in terms of medical costs. Deductibles under the Bronze level can reach thousands of dollars, meaning you will have to pay quite a bit out of pocket for medical services before your insurance kicks in and takes over the costs.

The Silver Level

In the Silver level, the insurance company pays roughly 70% of total medical costs and you pay 30%. It’s good for those who qualify for cost-sharing reductions (CSR), which is a discount that lowers the amount owed for deductibles and copays. If you qualify for CSR, you must choose a Silver plan to receive the extra savings. If you use extensive care, you could save hundreds or even thousands of dollars per year!

The Silver plan has a higher monthly premium than the Bronze but is still relatively cheap. This also means that medical costs will continue to be the beneficiary’s responsibility until their deductible — which is lower than Bronze but can still run quite high — is reached.

The Gold Level

In the Gold level, the insurance company pays roughly 80% of total medical costs and you pay 20%. It’s good for those who have a greater need for medical coverage, but might not be able to afford the Platinum level.

Since this level covers MORE costs when you get medical treatment, there’s a high monthly premium. However, this means that your deductible will typically be lower, so if high-cost medical needs arise, insurance will kick in sooner.

The Platinum Level

With the Platinum level, the insurance carrier pays roughly 90% of total medical costs and you pay 10%. It’s good for those who have a significant need for medical care, such as chronic conditions or injuries.

The Platinum level has the highest monthly premium, which then translates to lower costs when seeking health care, and much lower deductibles.

Note: Premiums may be lower depending on your income, so you could save money.

When picking a metal level, it’s best to look at the type of health care you may need, and weigh those costs against the cost of a monthly premium to decide which option is better for you in the long run.

Give Us a Call Today

Whether you’re in the market for health, life, Medicare coverage, or another type of insurance, we’re here to help. iHealthcare Direct is committed to finding you the best solution for the best price. Call today to get started — it won’t cost you anything!

Many individuals have not yet retired when they're eligible for Medicare, so they may still have health insurance coverage. Now that they have hit 65, though, they are also eligible for Medicare as well. Is it possible to have two different health insurances, one of them being Medicare, at the same time?

Yes, it's quite possible to be enrolled in both private insurance and Medicare at the same time. Receiving coverage from both a private insurance company, as well as Medicare, is referred to as a “coordination of benefits.” This coordination of benefits determines if the private insurance provider or Medicare will pay for medical expenses/costs first. The insurance that is required to pay first is the “primary payer.” Medicare can sometimes be deemed the primary payer when it comes to the two insurances. It depends on what type of private insurance coverage you have to fully determine who is the primary payer and who is the secondary payer.

Once the order of payment is decided, the steps to apply coverage are as such:

- The primary payer, which is sometimes Medicare, pays for any medical services until their coverage limit has been reached.

- Then the secondary payer, which could be the private insurance, finishes up by paying for anything that the primary payer did not cover in the beginning.

What Different Types Of Coverage Can You Have With Medicare?

If you're still employed but became eligible for Medicare and enrolled during your Initial Enrollment Period, you're allowed to have private health insurance coverage through your employer. You may also still be enrolled on your spouse’s group plan if they're still receiving health insurance from their employer and receive Medicare at the same time.

You're also able to be enrolled in Medicare and COBRA at the same time. COBRA is a plan that allows you, or your spouse, to temporarily keep private health insurance coverage once employment ends. Finally, you can also enroll in TRICARE and Medicare simultaneously. TRICARE is insurance coverage for active military personnel, as well as retired military veterans. It also provides coverage for their dependents. In order to be able to have both TRICARE and Medicare at the same time, you must:

- Be 65 or older and enrolled in Medicare Part B

- Have a disability, end-stage renal disease (ESRD), or amyotrophic lateral sclerosis (ALS), and be enrolled in both Medicare Part A and Part B

- Have Medicare and are a dependent of an active duty service member with TRICARE coverage

Call Us Today

While most individuals that are 65 and older only have Medicare as their primary insurance, there are some who already have insurance but have entered into their Initial Enrollment Period for Medicare and are scared to apply due to active health coverage. But there’s no need to worry! It’s possible to have private health insurance from another provider and still receive health coverage and benefits from Medicare.

To learn more about having other health insurance with Medicare, give us a call today!

There are so many different health plans available. Choosing the right one for your needs may seem overwhelming at first, as there are many different options. However, researching and speaking with an insurance professional are great ways to learn more about the different possibilities and select the one that will be best for you.

Deductibles are amounts that are typically paid yearly. Before an individual reaches their deductible, they won’t have the full scope of their health insurance policy. Once the deductible is met, they will typically have access to their full policy. Deductibles are expected to be paid entirely out-of-pocket, though there is a program that can help pay for some deductibles.

High-Deductible health plans

High-deductible health plans are an insurance option that some choose in order to save money. This may sound contradictory, as they do have a higher deductible than other plan options. However, these types of policies typically have lower premiums.

Premiums are amounts that must be paid monthly, whether or not you use your health insurance coverage. Deductibles are amounts that are only paid when your coverage is used. This means that you could potentially save more money if you don’t use your health insurance coverage.

Why choose a high-deductible option?

If you are not anticipating using your health insurance but still want to have it in case of an emergency, then this is an excellent option to save you as much money as possible.

Medigap

Medigap is supplemental insurance that’s solely for those enrolled in Original Medicare. The purpose of Medigap is to cover some of the costs that would otherwise need to be paid for out-of-pocket. Enrolling in Medigap is an excellent way to save money and make sure that you’re paying as little as possible. There are two different Medigap policies that have high-deductible options. It’s important to keep this in mind while you’re looking at all of the choices that are available to you.

Making the right insurance choices for you

There are so many different things to keep in mind when you’re looking at different insurance policies. What areas of your insurance you’ve used in the past, any current medical needs you have, and what you’re anticipating the future being like are all things that should be taken into account. High-deductible policies are an excellent choice if you’re not anticipating using your health insurance and are looking for a low premium option. Taking advantage of this choice is a great way to save money while still having access to healthcare.

If you’re interested in learning more about your health insurance options, you can contact us today. We’re here to provide you with information and make sure you have the tools you need to select the right policy for you. We look forward to speaking with you and working with you on your health insurance journey.

ACA plans refer to health insurance plans that are sold on the health insurance marketplace. These marketplaces are managed by the state or federal government. By law, All ACA plans must cover certain essential benefits. These benefits must include:

- Emergency services

- Outpatient services

- Hospitalization

- Maternity care

- Mental health care

- Behavioral health services

- Prescription drug coverage

- Rehabilitative services

- Habilitative services

- Pediatric services

- Preventive and chronic disease management services

There are four different types of ACA plans: PPO, POS, HMO, and EPO.

PPO, HMO, POS, and EPOs

Preferred Provider Organization plans (PPO) are one of the most popular ACA plans. PPO plans allow you to visit any in-network provider without requiring a referral. Also, the plan provides coverage for in-network and out-of-network care, though out-of-network care costs more. If you want the freedom to choose any healthcare provider or you want some out-of-network care coverage, then PPO plans may be right for you.

HMO plans will require you to choose a primary care doctor, and you will need a referral for specialist visits. However, many HMO plans have lower out-of-pocket costs. This is because HMOs provide healthcare coverage that is limited to in-network providers.

Point of Service plans are basically a combination of HMO and PPO plans. Like an HMO, a POS will require you to choose a primary care doctor and get referrals when needed. But, like a PPO plan, you can also receive your care outside of the provider network, though this will cost more.

With Exclusive Provider Organization (ECO) plans, you can exclusively use the healthcare providers within the plan network but cannot get coverage for out-of-network care.

ACA Plan Categories

ACA plans are also grouped by metal tiers, or categories. The metal tiers are not used to determine the quality of care. They are used to determine how the costs will be split between you and your chosen plan.

The four metal tiers are bronze, silver, gold, and platinum. In the bronze plan, 60% of medical costs are paid by the insurer, while the consumer covers 40%. Bronze tier plans have the lowest monthly premiums, but the highest out-of-pocket costs.

Silver plans cover 70% of medical costs while the policyholder covers 30%. The monthly premium cost is considered moderate compared to higher tiers.

Gold plans have higher premiums but lower deductibles. They cover 80% of the medical costs, while you cover 20%.

Platinum tier plans cover 90% of the medical costs. They have the lowest deductibles but have the highest premiums. However, the plan will cover almost all the medical costs.

Contact Us Today!

At iHealthcare, our agents will guide you through the process of choosing an affordable health insurance plan suitable for your healthcare needs. For more information on how we can help, call us today at 713-900-1901.