Healthcare coverage is a vital thing that can also be pricey. Low-income individuals may find themselves struggling to pay monthly premiums if they get private insurance and/or do not qualify for programs like Medicare and Medicaid. With few options to protect themselves and their families, it can cause tremendous anxiety.

However, the Affordable Care Act (ACA) subsidy can help by lowering the cost of monthly premiums for those who qualify. These subsidies work as financial aid, similar to how tuition grants and scholarships work for college students.

In this case, the government picks up the amount that cannot be paid by an individual or household.

How Do I Qualify?

To qualify for an ACA subsidy, your or your household’s net income must be between 100% and 400% of the Federal Poverty Level. The amount you may qualify for will depend on the insurance plans available in your coverage area. Look into the different ACA levels to see how much monthly premiums cost in your zip code.

Also note that if your or your household’s income ends up being higher than the Federal Poverty Level, once taxes have been filed, you may be subject to back pay for the medical costs covered throughout the previous year.

How Do I Apply for an ACA Subsidy?

To apply for an ACA subsidy, you must first meet the requirements. If you’re not sure if you or your household does, you can check your eligibility through the online marketplace, and it will calculate your net income for you — letting you know if you’re within the Federal Poverty Level range.

Once you know that you qualify for an ACA subsidy, you have two choices: 1) You can apply the subsidy in advance, to lower your monthly premiums as you pay them throughout the year, or 2) you can wait and claim the money that you would’ve saved during the year on your next tax return.

If you don’t apply for an ACA subsidy or just don’t think you qualify but later realize that you do, you’ll be refunded once you’ve filed your taxes.

What Will Disqualify Me?

In order for you or your household to qualify for an ACA subsidy, those of you applying must be either U.S. citizens or legal residents currently residing in the United States.

If you’re concerned about your ability to afford healthcare insurance, look into whether or not you meet the qualifications listed above, and see if you can alleviate some of your financial stress by receiving an ACA subsidy.

Get Coverage Today

If you’re in the market for affordable health insurance, iHealthcare Direct can help. iHealthcare Direct is an expert in the healthcare field and our agents can help you navigate through dozens of options. Call iHealthcare Direct and see how you can get insured today!

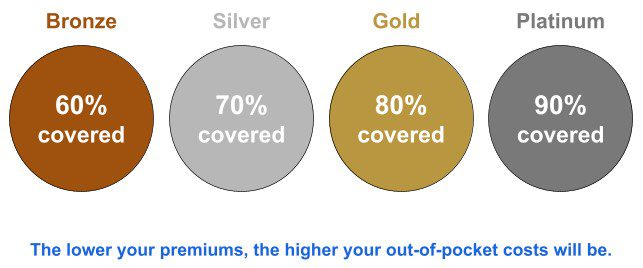

The health insurance plans under the Affordable Care Act (ACA) are divided into four categories, referred to as the “metal” levels, as they are ranked as Bronze, Silver, Gold, and Platinum. Each level is determined by its actuarial value (the percentage of how much your plan pays for benefits covered by the insurance). Metal categories are based on how you and your insurance plan divide the costs of your care — they don’t refer to the quality of care.

iHealthcare Direct can help you determine which level of health coverage is right for you.

The Bronze Level

In the Bronze level, the insurance company pays roughly 60% of medical costs, and you pay 40%. This category is good for those who want the protection for serious medical emergencies, but don’t need as much coverage for routine procedures, general health and wellness care, and screenings.

The Bronze level has the lowest monthly premium but also covers the least in terms of medical costs. Deductibles under the Bronze level can reach thousands of dollars, meaning you will have to pay quite a bit out of pocket for medical services before your insurance kicks in and takes over the costs.

The Silver Level

In the Silver level, the insurance company pays roughly 70% of total medical costs and you pay 30%. It’s good for those who qualify for cost-sharing reductions (CSR), which is a discount that lowers the amount owed for deductibles and copays. If you qualify for CSR, you must choose a Silver plan to receive the extra savings. If you use extensive care, you could save hundreds or even thousands of dollars per year!

The Silver plan has a higher monthly premium than the Bronze but is still relatively cheap. This also means that medical costs will continue to be the beneficiary’s responsibility until their deductible — which is lower than Bronze but can still run quite high — is reached.

The Gold Level

In the Gold level, the insurance company pays roughly 80% of total medical costs and you pay 20%. It’s good for those who have a greater need for medical coverage, but might not be able to afford the Platinum level.

Since this level covers MORE costs when you get medical treatment, there’s a high monthly premium. However, this means that your deductible will typically be lower, so if high-cost medical needs arise, insurance will kick in sooner.

The Platinum Level

With the Platinum level, the insurance carrier pays roughly 90% of total medical costs and you pay 10%. It’s good for those who have a significant need for medical care, such as chronic conditions or injuries.

The Platinum level has the highest monthly premium, which then translates to lower costs when seeking health care, and much lower deductibles.

Note: Premiums may be lower depending on your income, so you could save money.

When picking a metal level, it’s best to look at the type of health care you may need, and weigh those costs against the cost of a monthly premium to decide which option is better for you in the long run.

Give Us a Call Today

Whether you’re in the market for health, life, Medicare coverage, or another type of insurance, we’re here to help. iHealthcare Direct is committed to finding you the best solution for the best price. Call today to get started — it won’t cost you anything!