While Medicare helps pay for your health care expenses, it has many guidelines and rules, making it confusing now and then. It turns out that Medicare mistakes are most common in a Medicare member’s first year of coverage. Instead of learning the hard way, you can stay in front of things you shouldn’t do to avoid the common Medicare errors altogether. Here are the 3 costly Medicare mistakes to avoid if you want to make the best decision for your healthcare needs.

Not Enrolling on Time

Delaying Medicare enrollment is one of the most expensive and common Medicare mistakes you can make. As you approach 65, you will want to enroll for Medicare during your Initial Enrollment Period (IEP). This is a 7-month period that starts 3 months before your 65th birthday and extends through the 3 months following your 65th birthday month. You may have to pay late Medicare enrollment penalties for the rest of your life for the failure to sign up for Medicare during your Initial Enrollment Period.

However, it is possible to delay your enrollment if you are eligible for a Special Enrollment Period (SEP). If you fail to enroll during the SEP, you may also incur late fees.

Ignoring Plan Changes

Failing to read your Annual Notice of Change (ANOC) or Evidence of Coverage (EOC) can be costly. These are important documents that Medicare beneficiaries receive in the mail in September if they are enrolled in a Medicare Advantage plan or Medicare Part D prescription drug plan. They state the changes your plan will make to its coverage and cost for the coming year.

Once you have reviewed these documents, you can make the necessary changes during the Annual Enrollment Period (October 15 - December 7). Suppose you are not satisfied with your plan’s changes but fail to use the Annual Enrollment Period to your advantage. In that case, you can be doing more harm than good as you will be sticking with a plan that may cost more and no longer provide the coverage you need.

Receiving Care Outside of Your Plan’s Network

If you opt for the Medicare Advantage plan, you may be required to use the plan’s network of hospitals and doctors to get coverage for your medical expenses. It is vital to make sure your hospitals, doctors, and other providers are covered in your plan annually. You won’t only pay more for seeking healthcare outside of your plan’s networks; all the paperwork will also be your responsibility.

Need Help?

Contact iHealthcare Direct to speak with a licensed and experienced Medicare agent to help address your concerns and find a Medicare plan that fits your coverage and budget needs.

Medicare terms can sometimes seem like an unknown language, but understanding some of the most common Medicare terms can help make it easy for you to navigate through your Medicare options and make an informed decision. We have defined the top 5 Medicare terms you should know as you prepare to choose a Medicare plan that fits your needs.

Benefit Period

This is the set amount of time during which Medicare will pay for Skilled Nursing Facility (SNF) and hospital services. The benefit periods start upon your admission to a hospital or skilled nursing facility. It ends once you have been discharged and didn’t receive any inpatient hospital care for at least 60 days.

In the situation where you are readmitted to a hospital or SNF within the 60-day period, you’ll be in the same benefit period. A new benefit period will start if you are admitted after those 60 days have passed, and you will be subject to the Medicare Part A copays and deductibles.

Cost-Sharing

This refers to the portion of medical services received that you are responsible for paying. Cost-sharing includes a combination of deductibles, copayments, or coinsurance. Medicare Supplement Plans K and L are good examples of cost-sharing plans. Plan K typically covers 50% of out-of-pocket costs, whereas Plan L covers 75%.

Donut Hole

This is also known as the Coverage Gap. This is one drug coverage stage a beneficiary may experience while they are a member of the Medicare Part D plan. This is the period during which there is a gap in the prescription drug coverage provided by Medicare Part D. And you’ll remain in this hole until your out-of-pocket spending meets the predetermined limits.

Formulary

The formulary is referred to as the list of medications that a Prescription Drug Plan covers. The formulary includes both generic and brand name drugs and contains at least two of the most commonly prescribed medications within each drug class.

Initial Enrollment Period

The Initial Enrollment Period (IEP) is the 7-month period you have to enroll in Medicare when you turn 65. The 7-month period starts three months before the month you turn 65 and lasts until three months after you turn 65.

As you near retirement, you may wish to consult a Medicare professional to become familiar with the Medicare program. This is where we can help. If you have any questions about Medicare, contact iHealthcare Direct today, and we can help you find a plan that suits your needs.

Medicare Advantage plans, also known as Medicare Part C plans, are provided by private insurance companies approved by Medicare. Medicare Advantage plans provide coverage for all the services offered by Original Medicare, as well as other healthcare benefits such as prescription drug coverage. Medicare Part C covers different prescription drug types, helping you save money on your medications and reduce out-of-pocket costs.

Prescription Drug Coverage Under Medicare Advantage

Private health insurance companies manage Medicare Advantage plans, so the benefits vary between plans. However, many of the plans cover prescription drugs. When you register for a Medicare Part C plan, the private health insurance company will provide a formulary. The formulary lists the medications that are covered under the beneficiary’s plan.

The formulary is required by Medicare to cover different tiers of drugs. Each formulary must contain at least 2 drugs in the most common medication categories, such as blood pressure and diabetes medications.

- Usually, generic drugs are the lowest-cost drugs, and they serve as the alternative to brand-name drugs. You can find most of the generic drugs in the formulary Tier 1, and this has the lowest copayment.

- Tier 2 medications have an average copayment and mostly include brand-name drugs and a couple of generic drugs.

- Tier 3 drugs have a higher copayment, which includes both brand name and generic prescription drugs.

- Specialty-tier drugs are the ones that have a higher cost, so you pay the highest copayment.

The insurer will have to approve all the medications listed on the Medicare Advantage plan’s formulary, and each plan will vary according to how the drugs are organized on their formulary. Before you enroll for Medicare Part C, you should review the formulary of the plan. While you may not find a formulary that contains all the drugs you require, opting for a Medicare Advantage plan that has the most coverage can save you money.

Finding a Medicare Advantage Plan with Prescription Drug Coverage

There are several ways to find Medicare Advantage plans with prescription drug coverage. If you qualify for a Medicare Advantage Special Needs Plan, these plans are required to provide prescription drug coverage.

Choosing a plan with prescription drug coverage can be challenging at a glance, but iHealthcare Direct can help you compare every Medicare Advantage plan available in your area. Our experienced Medicare experts can filter the available options according to your needs and then evaluate them side by side.

Contact iHealthcare Direct today for any Medicare-related questions and assistance about Medicare Advantage and prescription drug coverage.

Medicare Supplement, also known as Medigap, is a health insurance plan designed to work with Original Medicare. However, Medicare Supplement insurance plans don’t work like most healthcare insurance plans because they don’t offer coverage for any health benefits. Instead, Medicare Supplements covers the costs Medicare beneficiaries are liable to pay for with Medicare Part A and Part B.

How Do Medicare Supplements Work with Original Medicare?

If you have Original Medicare, there are about ten standardized Medigap plans available for you. The Medicare Supplements are lettered A, B, C, D, F, G, K, L, M, and N. Each of these Medicare Supplement Plans may offer coverage for four or more of these benefits:

- Medicare Part A coinsurance for hospital costs

- Medicare Part A hospice care coinsurance or copayment

- Medicare Part A deductible

- Medicare Part B copayment or coinsurance

- Part B excess charges

- Part B deductible

- Skilled nursing facility care coinsurance

- The first three pints of blood

- Foreign travel emergencies

All Medigap plans cover 100% Medicare Part A hospital costs and coinsurance, but some plans only cover a certain percentage of other out-of-pocket costs. For example, while all Medigap plans cover the first three pints of blood for transfusions, they are provided at varying levels – Medicare Supplement Plan K covers 50%, and Plan L covers 75%. The remaining Medicare Supplement plans cover blood transfusions at 100%.

However, keep in mind that if you were not eligible for Medicare before January 1, 2020, you won’t be able to purchase Medigap Plan C and Plan F. These Medicare Supplement plans have been phased out, but Medicare beneficiaries who are already enrolled in one can keep it.

How Do They Work with Other Types of Health Insurance?

Medigap plans only work with Original Medicare. It is not designed to work with Medicare Part C, Medicare Part D, TRICARE, or Medicaid plans. It is illegal for any private insurance company to sell Medicare Supplement plans to those that already have Medicare Part C plans or Medicaid unless the Medicare Supplement coverage is ending. Also, Medigap plans don’t cover hearing, vision, or dental care, long-term care, or private nursing.

You can contact iHealthcare Direct for more information about how Medicare Supplement plans work. Our experienced Medicare experts can help you determine your next steps and find the best Medicare Supplement insurance plan for your needs.

In the U.S., a single hospital stay could be financially devastating — even for those with health insurance. One overnight stay in the hospital can wrack up thousands of dollars. If one stay costs that much, what would happen to you or your family if a serious medical issue that required a lengthy stay and numerous medical procedures were to occur? Whether you have decent savings or you’re living paycheck-to-paycheck, nobody wants to be drowning in medical bills, especially during an emergency.

This is where hospital indemnity insurance can come in handy.

Why Get Hospital Indemnity Insurance?

Hospital indemnity insurance is a type of supplemental coverage that pays benefits if you’re hospitalized. It’s not meant to replace your existing health insurance, but rather act as a safety net in the event of an emergency or needed hospital stay/procedure. You may also hear it referred to as hospital confinement indemnity insurance. Having this coverage will allow you to focus on recovery without having a financial setback.

What’s Covered?

Every hospital indemnity plan is different. Generally, it will cover hospitalizations and intensive care. Some programs may offer a set of policy riders to meet your individual needs, including:

- Ambulance trips

- Critical accidents

- Outpatient surgery

- Cancer treatments

- Skilled nursing

- Dental/vision

Is Hospital Indemnity Insurance Worth It?

That’s up to you — but it will help to look at your current finances and ask yourself these questions:

- If something critical were to happen to you or a family member, do you have the money to pay for hospital costs?

- Do you or does anyone in your family have a chronic condition that requires frequent hospitalizations?

- What does your current health insurance plan cover, and would it be enough to protect you in the event of a true medical emergency?

For some people, the hospital indemnity plan premium isn’t worth it, but for others, it can be a genuine lifesaver.

Talk to Your Insurer

With all the different hospital indemnity options available to you, it’s important to ask your insurer the right questions. Ask what types of hospital costs are covered and if there’s a cap on how much the insurance company is willing to pay. Also, find out how quickly payment will be received. Ask if you can cover your whole family, or if it's only you who will be covered.

Even if you don’t think it’s for you, it’s still worth it to take a look. Remember, a single accident could be what stands between you and medical debt. Explore your options and see if supplemental insurance is right for you.

Get Hospital Indemnity Insurance Today!

If you’re in the market for hospital indemnity insurance or any other kind of insurance, iHealthcare Direct can help. iHealthcare Direct is an expert in the healthcare field and our agents can help you navigate through a complex maze of options. Call iHealthcare Direct to get started!

Healthcare coverage is a vital thing that can also be pricey. Low-income individuals may find themselves struggling to pay monthly premiums if they get private insurance and/or do not qualify for programs like Medicare and Medicaid. With few options to protect themselves and their families, it can cause tremendous anxiety.

However, the Affordable Care Act (ACA) subsidy can help by lowering the cost of monthly premiums for those who qualify. These subsidies work as financial aid, similar to how tuition grants and scholarships work for college students.

In this case, the government picks up the amount that cannot be paid by an individual or household.

How Do I Qualify?

To qualify for an ACA subsidy, your or your household’s net income must be between 100% and 400% of the Federal Poverty Level. The amount you may qualify for will depend on the insurance plans available in your coverage area. Look into the different ACA levels to see how much monthly premiums cost in your zip code.

Also note that if your or your household’s income ends up being higher than the Federal Poverty Level, once taxes have been filed, you may be subject to back pay for the medical costs covered throughout the previous year.

How Do I Apply for an ACA Subsidy?

To apply for an ACA subsidy, you must first meet the requirements. If you’re not sure if you or your household does, you can check your eligibility through the online marketplace, and it will calculate your net income for you — letting you know if you’re within the Federal Poverty Level range.

Once you know that you qualify for an ACA subsidy, you have two choices: 1) You can apply the subsidy in advance, to lower your monthly premiums as you pay them throughout the year, or 2) you can wait and claim the money that you would’ve saved during the year on your next tax return.

If you don’t apply for an ACA subsidy or just don’t think you qualify but later realize that you do, you’ll be refunded once you’ve filed your taxes.

What Will Disqualify Me?

In order for you or your household to qualify for an ACA subsidy, those of you applying must be either U.S. citizens or legal residents currently residing in the United States.

If you’re concerned about your ability to afford healthcare insurance, look into whether or not you meet the qualifications listed above, and see if you can alleviate some of your financial stress by receiving an ACA subsidy.

Get Coverage Today

If you’re in the market for affordable health insurance, iHealthcare Direct can help. iHealthcare Direct is an expert in the healthcare field and our agents can help you navigate through dozens of options. Call iHealthcare Direct and see how you can get insured today!

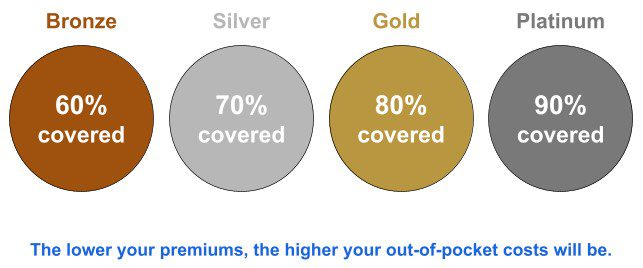

The health insurance plans under the Affordable Care Act (ACA) are divided into four categories, referred to as the “metal” levels, as they are ranked as Bronze, Silver, Gold, and Platinum. Each level is determined by its actuarial value (the percentage of how much your plan pays for benefits covered by the insurance). Metal categories are based on how you and your insurance plan divide the costs of your care — they don’t refer to the quality of care.

iHealthcare Direct can help you determine which level of health coverage is right for you.

The Bronze Level

In the Bronze level, the insurance company pays roughly 60% of medical costs, and you pay 40%. This category is good for those who want the protection for serious medical emergencies, but don’t need as much coverage for routine procedures, general health and wellness care, and screenings.

The Bronze level has the lowest monthly premium but also covers the least in terms of medical costs. Deductibles under the Bronze level can reach thousands of dollars, meaning you will have to pay quite a bit out of pocket for medical services before your insurance kicks in and takes over the costs.

The Silver Level

In the Silver level, the insurance company pays roughly 70% of total medical costs and you pay 30%. It’s good for those who qualify for cost-sharing reductions (CSR), which is a discount that lowers the amount owed for deductibles and copays. If you qualify for CSR, you must choose a Silver plan to receive the extra savings. If you use extensive care, you could save hundreds or even thousands of dollars per year!

The Silver plan has a higher monthly premium than the Bronze but is still relatively cheap. This also means that medical costs will continue to be the beneficiary’s responsibility until their deductible — which is lower than Bronze but can still run quite high — is reached.

The Gold Level

In the Gold level, the insurance company pays roughly 80% of total medical costs and you pay 20%. It’s good for those who have a greater need for medical coverage, but might not be able to afford the Platinum level.

Since this level covers MORE costs when you get medical treatment, there’s a high monthly premium. However, this means that your deductible will typically be lower, so if high-cost medical needs arise, insurance will kick in sooner.

The Platinum Level

With the Platinum level, the insurance carrier pays roughly 90% of total medical costs and you pay 10%. It’s good for those who have a significant need for medical care, such as chronic conditions or injuries.

The Platinum level has the highest monthly premium, which then translates to lower costs when seeking health care, and much lower deductibles.

Note: Premiums may be lower depending on your income, so you could save money.

When picking a metal level, it’s best to look at the type of health care you may need, and weigh those costs against the cost of a monthly premium to decide which option is better for you in the long run.

Give Us a Call Today

Whether you’re in the market for health, life, Medicare coverage, or another type of insurance, we’re here to help. iHealthcare Direct is committed to finding you the best solution for the best price. Call today to get started — it won’t cost you anything!

While most health insurance plans do not include coverage for routine dental, vision, and hearing care, these are important areas that affect your overall health. How, then, can you get the coverage you need to maintain your quality of life? And how do dental, vision, and hearing insurance plans work when you’re covered under the Affordable Care Act (ACA)?

How to Get Dental Coverage

In the insurance Marketplace, created by the Affordable Care Act, you can get dental coverage in two ways: as part of a health plan, or by itself through a stand-alone plan.

- Some Marketplace health plans include dental coverage. You can see which plans do when you compare them. If the plan includes dental, the premium covers BOTH health and dental benefits.

- In some cases, separate, stand-alone dental plans are offered. You can view them when you shop in the Marketplace. If you select a separate dental plan, you’ll pay an additional premium.

For children up to the age of 19, dental coverage is considered an essential need and must be available through the marketplace. This doesn’t mean that every dental procedure is covered. For example, preventative cleanings may be covered, whereas braces may not. Deductibles and copays may also be required.

For adults, dental coverage is not considered to be essential, meaning that your insurer isn’t required to offer a dental plan for you if you’re over the age of 19. If you’re able to enroll in a dental plan, you can choose between a high premium plan, which will lower the costs of your copays and deductibles, or a low premium plan, which will do the opposite.

How to Get Vision Coverage

Like with dental coverage, vision screenings and necessary corrections to vision are considered essential and required for those under the age of 19. Vision coverage for children is considered to be preventative care under the ACA, and won’t cost you extra.

Unfortunately, also as with dental, vision coverage is not “essential” for adults, meaning an ACA plan is not required to make a vision plan available. It’s possible that certain plans will offer a vision plan, but don’t bank on it.

If no plans in your area cover vision, and you’re in need of vision coverage, there are a couple of ways to go about obtaining it. If you’re employed and receive benefits, vision insurance is often offered. You can also purchase a private, separate vision plan. Depending on your needs, you’ll want to explore what exactly these stand-alone plans include and how high their premiums are.

How to Get Hearing Coverage

For children, hearing coverage is generally considered essential and preventative. However, if a child has hearing loss past the point of 19, they can continue to receive hearing benefits under their parents’ insurance until the age of 26.

For those who are considered deaf or hard-of-hearing, cochlear implants are often covered. This is not a guarantee.

While having insurance through the Marketplace doesn’t guarantee access to comprehensive hearing coverage, there are still parts of hearing health that may be covered. For example, your plan may cover a trip to an ENT, but not necessarily cover a pair of hearing aids.

If you already have chronic hearing problems, you cannot be denied coverage, but it’s important for you to look at plans carefully to see if they offer the benefits you need.

Call iHealthcare Direct

If you’re exploring your health insurance options, you’ve come to the right place. iHealthcare Direct is an expert in the healthcare field and our experts can help you navigate through hundreds of plans to find the best fit for your situation. Call today!

Medicare Supplement Plans, also referred to as Medigap, are not stand-alone Medicare Plans. They fill in the gaps in the Original Medicare Plan where the plan’s coverage stops. These plans are provided by private insurance companies, but they are approved by Medicare.

Original Medicare and Medigap

Original Medicare is composed of two of the four parts of Medicare: Part A and Part B. Medicare Part A is considered “hospital insurance,” while Medicare Part B is considered more along the lines of actual “health insurance,” since it covers sick visits and preventative services.

Once you enroll in the Original Medicare Plan, you’re eligible to enroll in a Medicare Supplement Plan or Medigap. Enrolling in one of these supplement plans does not replace your Original Medicare Plan — it simply helps reduce your out-of-pocket costs that are caused by what is not covered under Original Medicare.

Medigap assists with deductibles, copayments, and coinsurance costs. Some of the Medigap plans that are offered also offer coverage for things that Original Medicare would not, such as medical care when traveling outside the United States.

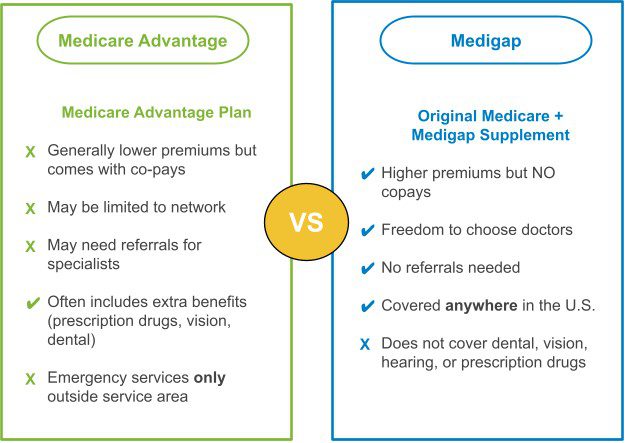

Medicare Advantage and Medigap

You cannot be enrolled in a Medicare Advantage Plan and a Medigap Plan at the same time. You’re only eligible for a Medigap Plan if you have both Parts A and B. Medicare Advantage Plans, also known as Medicare Part C, provide and usually exceed the benefits offered by Original Medicare.

Medigap fills in for Original Medicare; Medicare Advantage Plans not only provide hospital and medical coverage, but they also typically offer prescription drug coverage, as well as vision, dental, and hearing benefits. Some even offer transportation to and from the doctor and a free or discounted gym membership.

One advantage of being enrolled in Original Medicare and a Medicare Supplement Plan, though, is that you’re eligible to receive treatment anywhere across the United States, as long as they accept Medicare. When enrolled in a Medicare Advantage Plan, you typically enroll in either an HMO (Health Maintenance Organization plan) or a PPO (Preferred Provider Organization plan).

HMOs and PPOs have in-network providers that they prefer you to choose from. If you decide to seek out-of-network treatment, then you’ll pay more out-of-pocket, and may not receive any aid from your Medicare Advantage Plan at all. However, a PPO plan is a bit more lenient than HMO.

Important Facts To Know About Medigap Policies

Remember, in order to enroll in a Medicare Supplement Plan, you must first enroll in Medicare Parts A and B, aka Original Medicare. Medicare Supplement Plans and Medicare Advantage Plans are not the same types of plans.

- Medigap helps fill the gaps to ease your out-of-pocket costs.

- Medicare Advantage Plans actually provide full health insurance coverage once enrolled.

You may also be required to pay a monthly premium for your Medigap Plan. If so, you’re still responsible for paying the Medicare Part B monthly premium as well. As of 2006, Medigap plans cannot cover prescription medications, so you must purchase a separate Medicare Part D drug coverage plan. You’re also responsible for that premium, although some people qualify for the Extra Help program.

Want to Learn More? Reach Out Today

At iHealthcare, we care about providing you with as much information as possible about your Medicare options. If you’re interested in a Medicare Supplement Plan and would like to learn more about the coverage involved with a Medicare Supplement, give us a call today. We’re here to help!

Original Medicare is made up of Medicare Part A and Medicare Part B. It is also referred to as “traditional Medicare,” because these benefits are received directly from the government, and not a private insurance company.

Medicare Part A Explained

Medicare Part A is also referred to as the hospital, or inpatient coverage part of the Original Medicare Plan. Medicare Part A covers 4 different services:

- Inpatient hospital care

- Skilled nursing facility (SNF) care

- Home health care

- Hospice care

To receive coverage for inpatient hospital care, you must be admitted by a physician into the hospital. You're eligible for up to 90 days of coverage as an inpatient during each benefit period. You also have 60 lifetime reserve days.

A benefit period measures the use of your inpatient or SNF care benefits. It ends once you have been out of the hospital or SNF care for 60 consecutive days. If you've reached your deductible, Original Medicare will cover your inpatient hospital stay 100% for days 1-60. Once you reach day 61, you're required to pay a daily coinsurance up until you reach day 90 of your inpatient hospital stay. If you require more time, you may also use your lifetime reserve days, but you're required to pay a daily coinsurance cost to use them as well.

To qualify for SNF care coverage, you must have first spent three consecutive days in a hospital as an inpatient within the last 30 days of being admitted into SNF care. You must also require skilled nursing and or/therapy services. If eligible, Medicare will cover your room, board, as well as a variety of services provided in a skilled nursing facility. You qualify for 100 days for each benefit period. If you're eligible for home health care, then you qualify for 100 days of daily care or an unlimited number of days with intermittent care. You will qualify for hospice care if your healthcare provider deems you terminally ill.

Medicare Part B Explained

Medicare Part B is also referred to as the medical, or outpatient, coverage part of the Original Medicare Plan. Medicare Part B covers two areas: medically necessary services and preventative services. This includes areas such as DME, or durable medical equipment coverage. Durable medical equipment is equipment that is medically necessary, durable, and useful in the home. Once your physician confirms you are in need of DME, you may purchase it from any Medicare-approved supplier. Medicare Part B also covers home health and ambulance services, therapy, and mental health services. This is not a full list of the coverage that Medicare Part B provides, but it is a glimpse of what it does provide coverage for.

Medigap

Why is Medigap relevant when learning about Original Medicare? Because it supplements or adds to the basic Medicare plan. Once you're enrolled in Medicare Part A and Part B, aka Original Medicare, then you can purchase a Medigap plan, which will help fill in the coverage gaps and reduce your out-of-pocket costs when you receive medical care. Even though Original Medicare may cover a lot, it does not fully cover your health needs. Medigap, or Medicare Supplement Plans, partners with Original Medicare to better provide coverage for those enrolled in traditional Medicare.

Need Medicare? We Can Help!

Making decisions about healthcare is important and having all the information you need to make the best choice for you is imperative. At iHealthcare, our agents will sit down with you and discuss what option will work for your current situation. To get a free quote today, give us a call at 713-900-1901.