ACA RESOURCES

New: 2026

Federal Poverty Guidelines

For Premium Tax credit (Subsidy)

Tax Credits can help lower your cost of your health insurance.

To qualify for tax credit your income must be between 100% to 400% of the Federal Poverty Level

To qualify for tax credit your income must be between 100% to 400% of the Federal Poverty Level

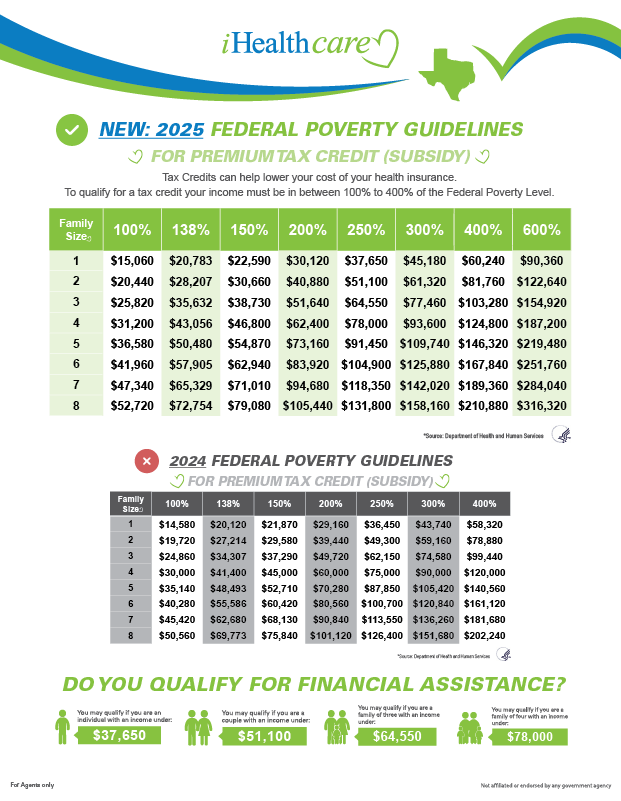

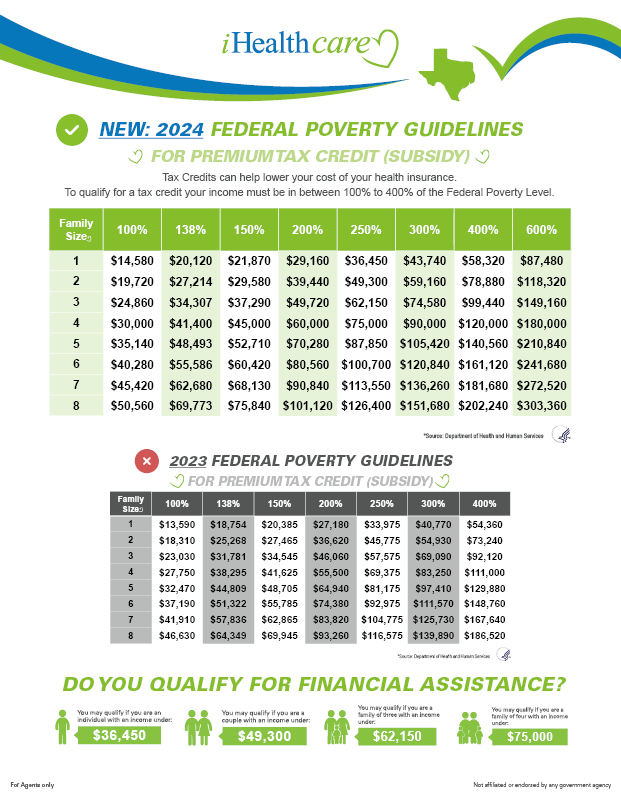

| Family Size | 100% | 138% | 150% | 200% | 250% | 300% | 400% | 600% |

| 1 | $15,650 | $21,597 | $23,475 | $31,300 | $39,125 | $46,950 | $62,600 | $93,900 |

| 2 | $21,150 | $29,187 | $31,725 | $42,300 | $52,875 | $63,450 | $84,600 | $126,900 |

| 3 | $26,650 | $36,777 | $39,975 | $53,300 | $66,625 | $79,950 | $106,600 | $159,900 |

| 4 | $32,150 | $44,367 | $48,225 | $64,300 | $80,375 | $96,450 | $128,600 | $192,900 |

| 5 | $37,650 | $51,957 | $56,475 | $75,300 | $94,125 | $112,950 | $150,600 | $225,900 |

| 6 | $43,150 | $59,547 | $64,725 | $86,300 | $107,875 | $129,450 | $172,600 | $258,900 |

| 7 | $48,650 | $67,137 | $72,975 | $97,300 | $121,625 | $145,950 | $194,600 | $291,900 |

| 8 | $54,150 | $74,727 | $81,225 | $108,300 | $135,375 | $162,450 | $216,600 | $324,900 |

Do You Qualify For Financial Assistance?

FPL Chart History

Review the historical Federal Poverty Level (FPL) charts from previous years.

Helping individuals and families access affordable healthcare. iHealthcare offers personalized services to our clients, helping them find the best possible healthcare solutions for their needs.

Get A Quote